The MainFood Groups ofReal Estate Investing

You've got options

When adding real estate to your investment portfolio, there’s a whole menu to choose from. Popular options include REITs, single family rentals, direct investment in commercial properties or grouped investments like blind funds, syndications or crowd sourcing platforms. When choosing what’s best for you, it’s important to have a firm grasp of the pros and cons of each.

REITs

The simplest, most straightforward way to add real estate to your portfolio is through Real Estate Investment Trusts (“REIT”). REITs have two main categories, public and private. Public REITs are traded on a stock exchange, while private REITs aren’t publicly traded. For the purposes of this discussion, I’ll be referring to public REITs. Private REITs are also a viable option, but in many ways behave more like private equity investments.

REITs usually have a specialty, which can be anything from hotels or apartments to self-storage facilities or mortgage debt. But all REITs have the same basic structure where a group of shareholders owns the company, and the company owns real estate assets.

Most importantly, REITs have two primary advantages over other types of real estate investing: ease of access and liquidity. As I type this, I can buy a single share of Boston Properties for a little under $120. And for that $120 price, I can pretty much instantaneously own (or sell) a piece of a company that owns dozens of Class-A office buildings throughout the United States. That’s the magic of REITs.

REITs have two primary advantages… ease of access and liquidity.

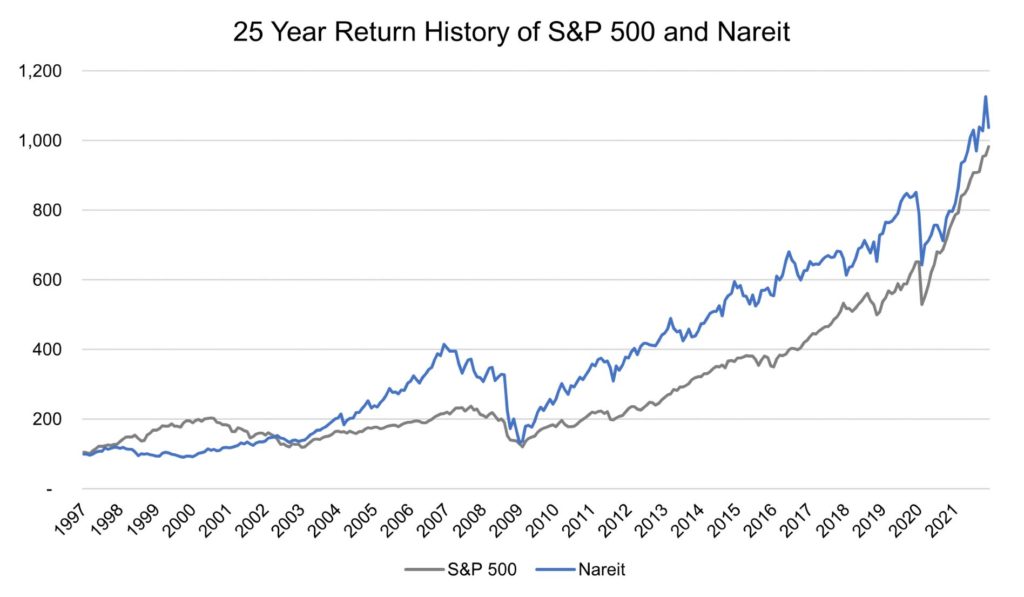

However, these benefits come with some drawbacks. The first and most obvious is volatility. Below is a comparison of the returns of the S&P 500 and the FTSE Nareit All Equity REITs Index over the last 25 years1. Over those 25 years, the Nareit index slightly outperformed the S&P 500 but with a significantly more volatility, with the Nareit index experiencing 19.7% standard deviation compared to 13.1% in the S&P 500.

The second, less obvious, downside to REITs is their return profile. In the above chart the Nariet index returned 9.8% annually. Given that REITs use debt and are therefore levered investments, a 9.8% return is below typical target returns for many other forms of real estate investment.

REITs Summary

Pros:

- Liquidity

- Low cost of entry

Cons:

- Relatively high volatility

- Historical returns are lower than target returns of other real estate investments

Single Family Rentals

Likely the second most common way that people invest in real estate is to buy a single family home as an investment and either flip it or rent it out. Thanks to HGTV, I’d guess that this is what most people think of when someone mentions real estate investing. For the purposes of this article, I’ll focus on single family rentals in particular, since these are buy-and-hold investments.

There was a great article recently published making the case for single family rentals (“SFR”) as an investment class. Overall, the study found that SFRs generated an average return of 8.5% and a standard deviation of 8.9%2. Overall, that’s quite good.

But the real advantage of SFRs is leverage. In most cases, an investor can get a mortgage up to 80% loan-to-value (“LTV”). As long as the market stays steady, with no unforeseen incidents, an investor can do really well with 80% LTV; it’s an accelerator for returns. Some people even choose to go what’s called the BRRRR route, which is Buy Renovate Refinance Rent Repeat. It’s not for everyone, but if you want to earn “sweat equity” through renovating and moving periodically, it’s a good way to parlay a single down payment into a portfolio of SFRs.

There are a couple real downsides to single family rentals though. The first and foremost is becoming a landlord. Many people who invest in single family rentals are true, hands-on landlords. They deal directly with finding tenants, screening tenants, fixing repairs, handling turnover and every other responsibility that comes up. If the phone rings at 3am because a water main broke, they’re the ones going out to shut it off and calling a repair crew first thing in the morning. It is possible to have a property manager act as a first line of defense, but as properties get smaller, good property managers are harder to come by and relatively more expensive, with some charging up to 10% of the property’s revenue.

Many people who invest in single family rentals are true, hands-on landlords.

The second, less obvious downside is risk. Not all cases are the same, but in general, SFRs have two risk factors that commercial properties don’t have: single tenants and the housing market. Since single family rentals only have one tenant, all your eggs end up in one basket. One bad tenant can (sometimes literally) sink an SFR investment. On top of that, SFRs have only two possible occupancies, 100% occupied or completely vacant, which creates larger swings in occupancy and income, compared to most commercial real estate investments that have multiple tenants. The housing market in turn can create swings in valuation that have nothing to do with the rental market. The housing market gets hot and cold periodically, which can be great for returns in a bull market, but in the long run, these swings end up creating volatility.

Single Family Rental Summary

Pros:

- Solid risk/return profile

- Ability to use lots of leverage (if desired)

Cons:

- Being a landlord or having to find and pay a good property manager

- Potentially riskier than commercial real estate

Direct Commercial Real Estate

Now we’re getting to the big guns. The commercial real estate sector accounts for everything from a five-unit apartment building to massive manufacturing facilities and high-rise office towers. It’s a wildly diverse and mind-bogglingly large sector. It’s also a favorite investment class of professional fund managers, typically making up 10-20% of large funds such as endowments and pension funds, and this is for good reason. Over the last 25 years, commercial real estate has generated unlevered average returns of 9.1% with standard deviation typically estimated as 4-5%, which is less than a quarter of REITs and significantly lower than SFRs3.

Similar to SFRs, CRE also allows for leverage that would be difficult to achieve with other asset classes. CRE investments can often get financing of 50-70% LTV, and considering the risk return profile mentioned above, using leverage is often a good tradeoff, since it becomes a significant factor to increasing potential return rates, with low baseline risk.

The issue with direct CRE investments for most investors is execution. CRE investments are complex. Unlike single family homes, CRE transactions aren’t standardized, pretty much everything is up for negotiation and there are few buyer protections. On top of their complexity, CRE assets are large investments, which can make diversification between assets difficult for all but the wealthiest investors, with even “small” CRE properties often costing in excess of $5 million.

The issue with direct CRE investments for most investors is execution.

Direct Commercial Real Estate Summary

Pros:

- Excellent risk/return profile

- Ability to use leverage

Cons:

- Complex

- Difficult to diversify

Passive (Grouped) Investments

In many ways, passive vehicles for investing in CRE are meant to solve the main two issues with direct CRE investing listed above. Grouped investments simplify CRE by using an investment professional, known as a sponsor, to direct and manage CRE investments. And by grouping funds together with other investors, each investor is able to diversify by investing in a greater number of assets.

Before delving into various forms of passive real estate investment, I think it’s critical to spend time on the key risk of grouped investment options. Years ago, a colleague and I were discussing a famous real estate investor who has bit of a “checkered” reputation. My colleague remarked “Yeah, he’s part of the 90% that give the other 10% a bad name.” And while he was mostly joking, there’s some truth in his remark. There are bad actors in real estate. And who you invest with matters. More than any other consideration, I believe that the risk of private equity, syndicated investments and crowd sourcing platforms is the quality of the sponsor. A good sponsor has both the ability and the willingness to do the right thing. Regardless of where you choose to invest, if you’re investing with a syndicator, a private equity fund or on a crowd-sourcing platform, do your homework on the sponsor. Ask questions. Run a background check. Talk to people who have worked with the sponsor before.

A good sponsor has both the ability and the willingness to do the right thing… do your homework on the sponsor.

Private Equity

Private equity firms pool investors into blind funds, which usually then invest with various other sponsors. Most funds will invest with several sponsors, making a few investments with each. For you as an investor, the private equity fund has done all the work and diversified your investment.

These funds do come with some notable drawbacks though. For one, they’re often called “blind” funds for a reason. The fund will have certain criteria for its investments, but the specific investments themselves are all TBD. The investors typically have no say in what they ultimately invest in. Because these funds invest in a number of different properties, the initial minimum investment also tends to be quite large. On top of that, once you’ve invested you’re locked in. Funds typically have a life of 5-7 years , and the fund has no obligation to return your money or profits anytime sooner. Finally, since most private equity funds are turning around and investing with other sponsors, the investor ends up paying two sets of fees: one to the private equity fund and one to the sponsor.

Private Equity Summary

Pros:

- Diversification

- Professionally managed

Cons:

- 5-7 year lockout

- No investor say on final investments

- Often require a large initial investment

- Two layers of fees

Syndications

Syndications group several investors together with a sponsor to buy a single invesment. Cloudline Investments is a syndication platform. Usually, the syndicator will identify an investment, investors will buy shares, and then the syndicator will manage the investment until it’s sold and the original investment plus profits have been distributed. Once again, this solves both the complexity and diversification issues of CRE listed above. The sponsor locates, vets, and negotiates for the purchase of an investment property. And by having a number of investors participate in each investments, each investor is able to invest in a greater number of CRE properties.

Similar to private equity funds, there is a lifecycle to the investment, and investors are unable to get their money back before the end of the lifecycle. In a syndication model, the investment lifecycle varies from investment to investment. Unlike private equity funds, investors are able to choose which properties they invest in. There’s typically only one layer of fess, paid to the syndicator. And minimum investments are usually much smaller than those required by private equity funds.

Syndications Summary

Pros:

- Diversification

- Professionally managed

- Investor selects which investments to participate in

- One set of fees

Cons:

- Lockout for the lifecycle of the investment

Crowd Sourcing

I won’t dive too deep into crowd sourcing here because crowd sourcing platforms vary significantly from platform to platform. Some are essentially private equity funds. Others are private REITs. While others still are really syndication platforms or listings of open deals with various syndication platforms. But depending on how they’re structured, the same principles and risks will apply.

Above all, before you invest with anyone, you should be 100% satisfied with their track record in the industry and their integrity as a fiduciary.

- S&P 500 and FTSE Nareit All Equity REITs Index monthly returns

- Demers, Andrew and Eisfeldt, Andrea L., Total Returns to Single Family Rentals (February 13, 2021). Available at SSRN: https://ssrn.com/abstract=3791631 or http://dx.doi.org/10.2139/ssrn.3791631

- First Quarter 2021 NCREIF Indices Review

More Insights

Commerical real estate has a unique combination of attributes that make it an excellent investment class and a worthwhile addition to most investment strategies.

All about how syndications work, from start to finish.

You’ve probably heard the term “Class A Building”. What do terms like this really mean? And better yet, what do they mean for investing?

A look at Cloudline’s market selection process. What are the demand drivers we focus on and how do they compare across major markets?

posted 2/18/2022