Why Real Estate

First Things First

Before becoming a real estate investor, internalize that investing is the key to building wealth and gaining financial freedom. Your money should be working for you, plain and simple. Whatever your financial goals are, investing will help you get there.

… investing is the key to building wealth and gaining financial freedom.

If you already invest, great. Direct real estate investments are a great component of a well-diversified portfolio. If you’re not already investing, get started. Either hire someone or do it yourself. Whether or not you end up using Cloudline as an investment platform, the refrain is the same: invest, invest, invest.

At Cloudline, one of our core beliefs is that commercial real estate investments have a multitude of benefits which make them superior to traditional stock market investments. There’s a reason that commercial real estate is regularly employed by institutional investors, such as retirement funds, endowments, hedge funds and private equity funds. Our service is ensuring that high-quality commercial real estate investments are accessible to you.

Cash Flow + Appreciation

Real estate investments generate returns in two ways: cash flow and appreciation. Real estate investments are operating businesses, which generate income. In real estate terms, this is called the Net Operating Income (“NOI”). Rents are collected monthly, and after paying operating expenses and loan payments, any remaining cashflow goes to the property’s investors. As a point of reference, Cloudline typically targets investments that distribute at least a 7% cash flow return annually. In the meantime, the property itself also tends to appreciate, making the original equity investment grow in value. Your investment grows while also providing cashflow.

Leverage

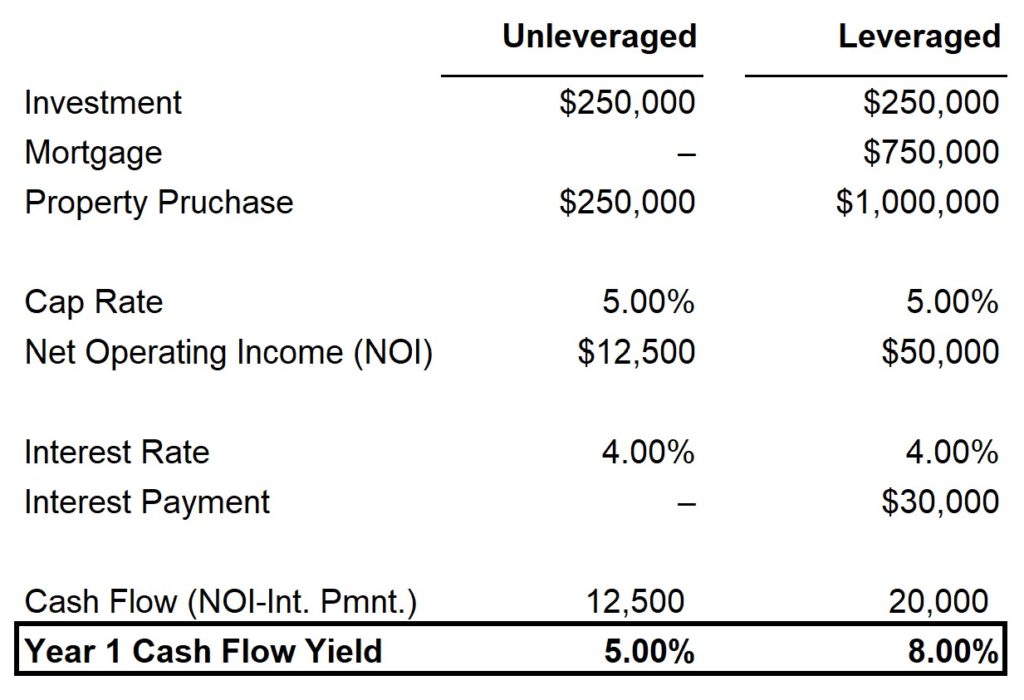

Real estate investments use mortgages to buy properties which are 2-4x the size of the initial equity investment. This is also known as using leverage. Leverage is the “secret sauce” for real estate investing. Consider an investment where the initial NOI yield is 5% of the purchase price, which in real estate terms would be called a 5% cap rate. On an initial investment of $250k, you can increase your year one cash flow from 5% to 8% by using $750k of leverage. That’s a 60% increase in cashflow, day one.

Leverage also has a pronounced effect on returns over the life cycle of an investment. For the same 250k investment in a 5% cap rate property and a 5-year investment lifecycle, assuming NOI grows by 4%, an investment with no leverage would return a 9% annual rate of return (“IRR”), ignoring transaction costs for simplicity. This same 250k investment would generate a 20.81% IRR using the same 750k mortgage loan detailed above. To put that into perspective, at a 9% IRR, your investment doubles every 8 years, and at a 20% IRR, it doubles every 3.6 years. Over a 10-year period, if you invest at a 20% IRR you’ll end up with 6x more money than if you never invested at all.

Over a 10-year period, if you invest at a 20% IRR you’ll end up with 6x more money than if you never invested at all.

Low Volatility

Direct commercial real estate investments are historically less volatile than the S&P 500 or REITs. Over the last 25 years, direct commercial real estate investments have had a standard deviation of 4.24%1, compared to 13.1% in the S&P 500 and 19.7% in the FTSE Nareit All Equity REITs Index2. Commercial real estate’s stability comes from two factors: private markets and cash flow. The market for commercial real estate is a private market, which is less reactive than public markets such as stock exchanges where billions of shares trade hands daily. A less reactive marketplace lowers volatility. A portion of real estate’s returns also comes from cash flow, which is often less volatile than appreciation3. Real estate generates revenue through rental payments which are usually dictated by a long-term lease agreement.

Commercial real estate’s stability comes from two factors: private markets and cash flow.

Tax Benefits

Real estate investors are allowed to deduct depreciation from rental income, lowering the tax burden of income generated through real property. You should speak with a qualified CPA to better understand how investing in real estate will affect your taxes.

Diversification

You’ve probably heard the saying, “Don’t put all your eggs in one basket”. And while not every adage holds water, diversification is backed by financial theory and is a key component to modern portfolio theory. Regardless of your financial goals, diversification is paramount to any good investment strategy.

Direct real estate investment has low correlation with other major investment classes, creating an excellent source of diversification for your investment strategy.

Correlation Between Commercial Real Estate and Other US Investment Classes (2000-2020)4

Industry Stability

Real estate investments are tangible assets that play important roles in the economy and have few if any substitutes. The way people use land and buildings may change over time, but sectors such as multifamily real estate provide a service that’s unlikely to be disrupted or replaced. People will always need places to live and work.

- First Quarter 2021 NCREIF Indices Review

- S&P 500 and FTSE Nareit All Equity REITs Index monthly returns

- Demers, Andrew and Eisfeldt, Andrea L., Total Returns to Single Family Rentals (February 13, 2021). Available at SSRN: https://ssrn.com/abstract=3791631 or http://dx.doi.org/10.2139/ssrn.3791631

- TIAA Whitepaper “Private real estate: Opportunity for income and diversification”.

More Insights

There are several different ways to invest in real estate. Take a quick spin through the pros and cons of REITs, single family rentals, commercial real estate, private equity, and syndications.

All about how syndications work, from start to finish.

You’ve probably heard the term “Class A Building”. What do terms like this really mean? And better yet, what do they mean for investing?